A smart approach to banking

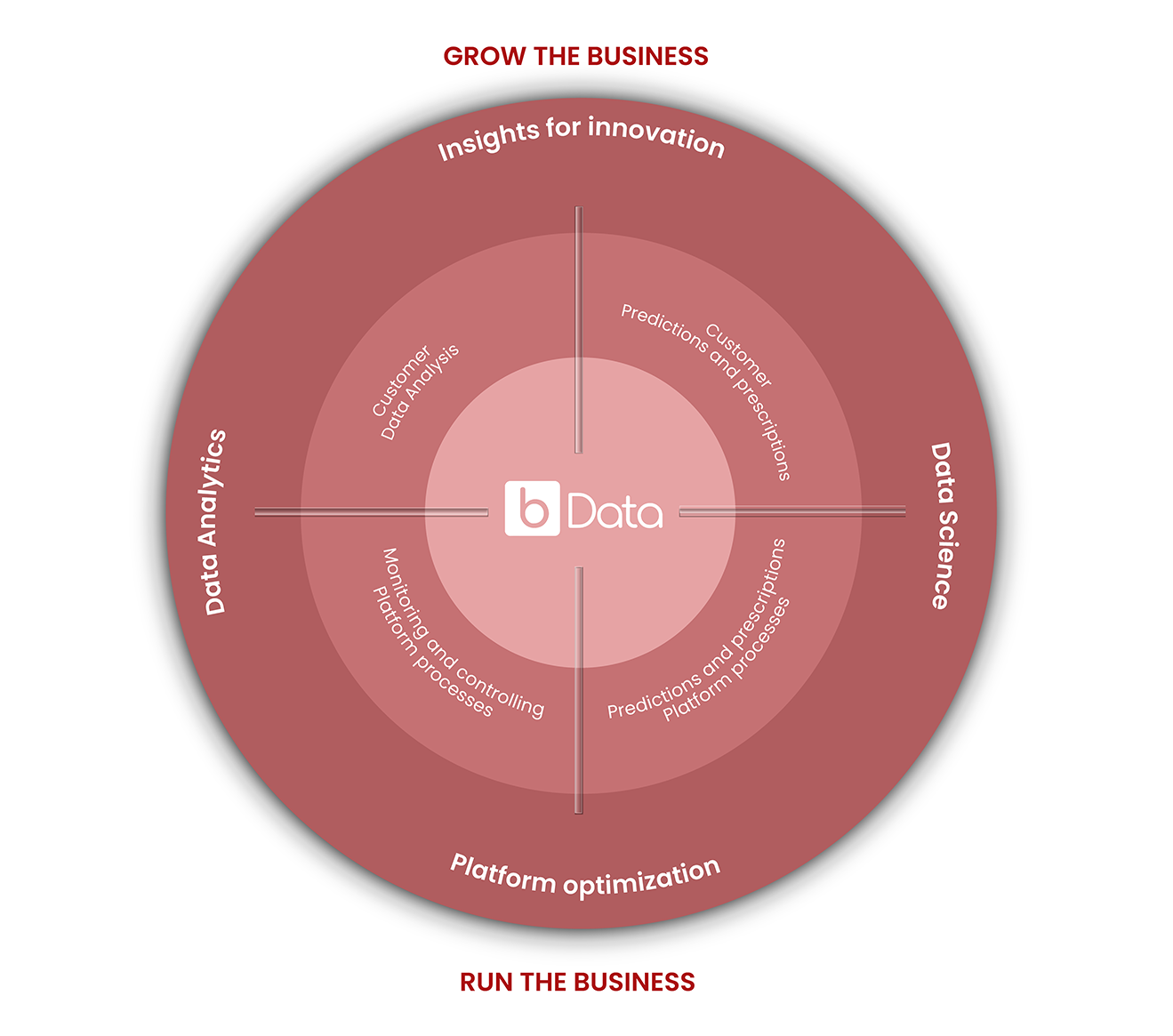

It is an area that specializes in the development of methods and techniques of analysis and data science, so that the Financial Institutions operating with the Bantotal Banking Platform can make smart decisions that allow them to innovate and optimize the performance of their platform.

Our solutions focus on two main areas of action:

Grow the Business

Brinda visibilidad de la relación con los clientes, permitiendo desarrollar propuestas que generen mayor volumen de negocio, rentabilidad y fidelidad.

Run the Business

It provides real-time platform visibility for monitoring and controlling the ongoing operation.

Smart banking approach fundamentals

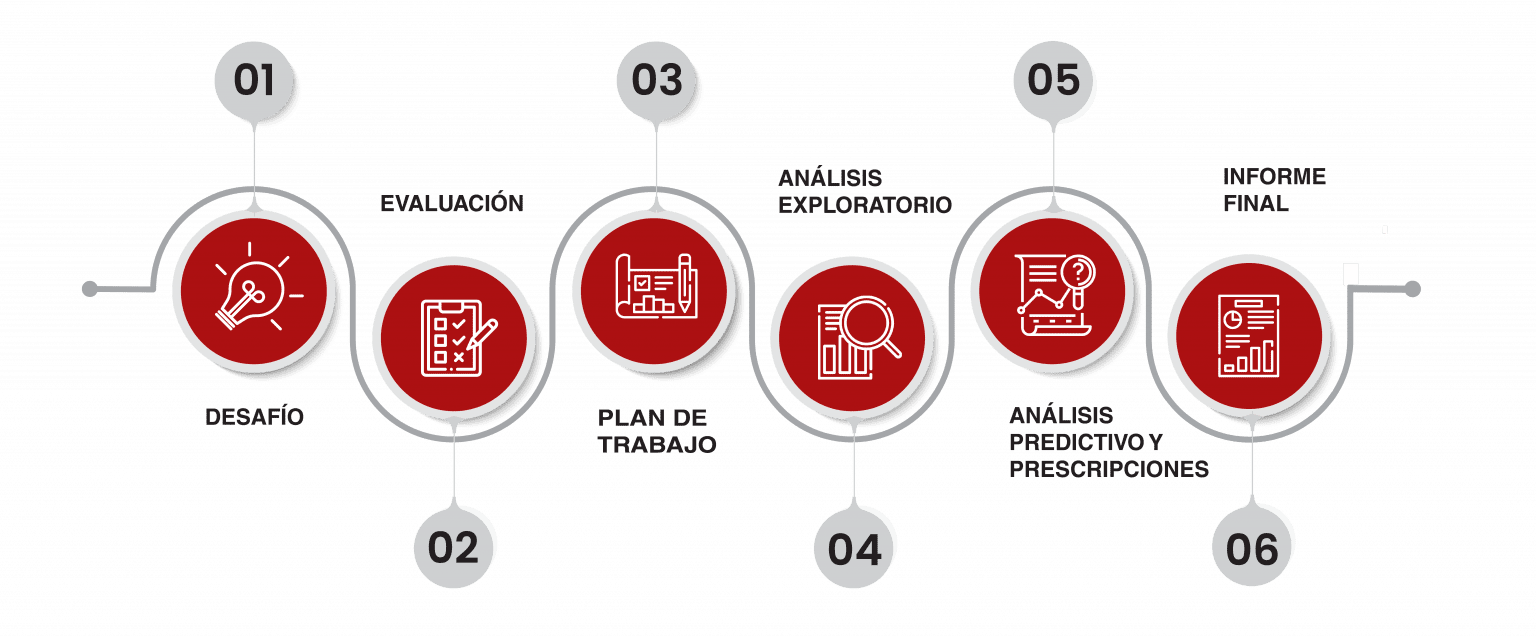

Smart Banking is a smart approach to the development of relevant relationships between financial institutions and their customers. This comes to life in six steps that involve the use of a set of processes and Tools and Techniques (T&T) taken from analytics and data science, which generate business information and knowledge used to make smart decisions.

BData Analytics

It provides solutions that give the Financial Institution visibility in terms of customer behavior and banking platform performance.

Services

It provides visibility over the service layer of the banking platform in real time. Through a complete Elastic (ELK) Stack (Elasticsearch, Logstash and Kibana) panel, it allows to identify errors and delays in the execution of services.

Customers

It provides data regarding customers and their behavior, allowing segmentation by demographic and behavioral variables, such as age, gender, products hired, transaction times, volume of business, etc.

End-of-day process

It provides organized information regarding the execution of the end-of-day process, which allows the visualization of relative times and deviations, as well as past queries of executions.

Digital channels

It provides customer behavior and operations data through Web and Mobile channels, as well as information related to Back Office.

BData Science

It provides AI-based solutions that give Financial Institutions the ability to predict behaviors and prescribe business decisions.

Behavior and pattern analysis

Customer churn prediction

Cross-selling

Other solutions

BData Consulting

We share our knowledge with the institution by providing tailored solutions

Our consultancy process follows six steps. First, we work with the client to define goals and research questions. Then, a team of experts performs a primary assessment that involves understanding the available data and sizing the solution. Once these two steps have been completed, we proceed to the plan development phase, which defines how the solution will be implemented. The next two steps are related to the execution phase and consist of performing an exploratory analysis through a statistical treatment of the data (it can be only this), and then performing the predictive analysis and prescriptions, based on the creation of models that use artificial intelligence. Lastly, we prepare and present a final report with findings and recommendations.

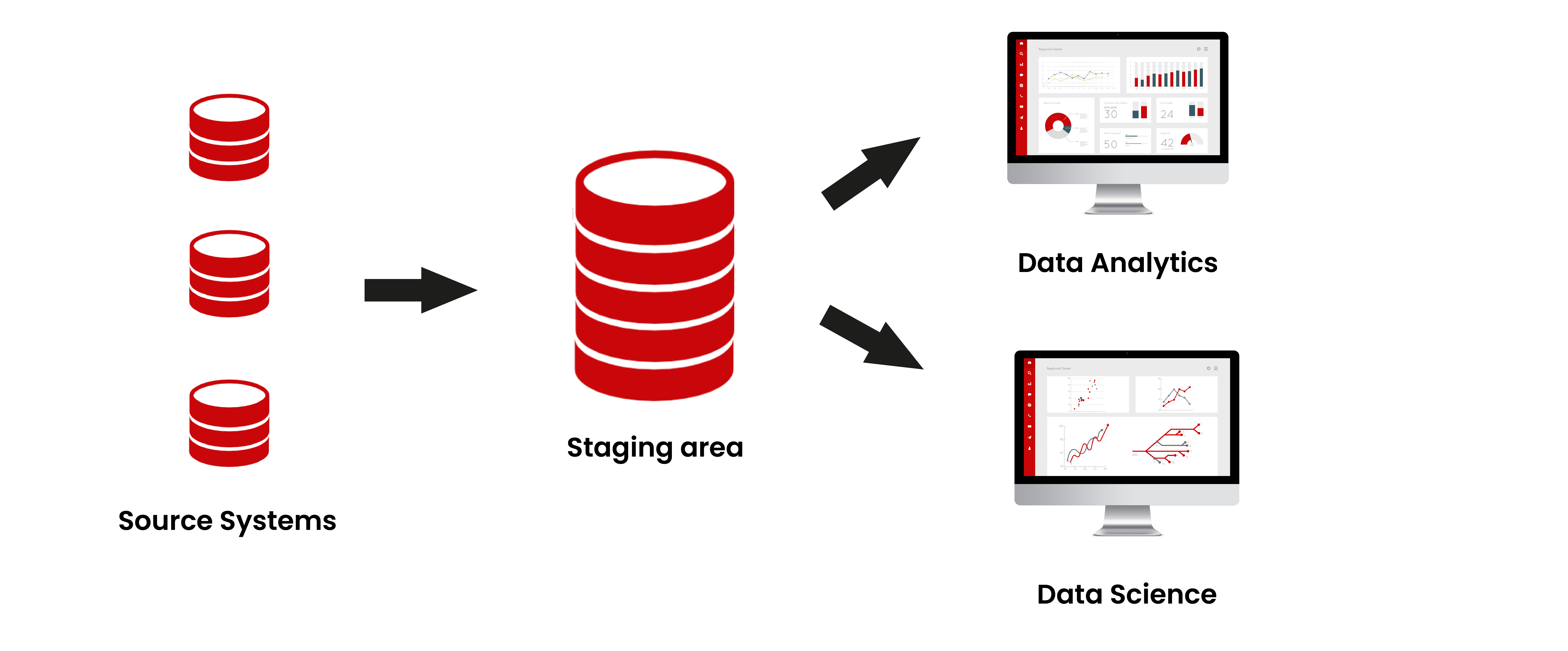

Staging

The goal of Staging is to empower Data Analytics and Data Science teams to perform exploratory analysis and modeling, without needing to know the transactional data model, thus democratizing access to information and accelerating the decision-making process in their business areas.

Explore our solutions

-

Bantotal Core

Bantotal Core is the centerpiece of our platform and solves all mission critical banking processes for Banks, Finance Companies, Fintech, Digital Banks, e-Commerce, Banking as a Service providers, etc. -

Microfinance

Bantotal Microfinance is the benchmark solution for microfinance companies, supporting the operation of the most important institutions in Latin America. This has enabled the incorporation of industry best practices and processes. -

Comex

Bantotal Comex is the solution that allows financial institutions to develop the business of Letters of Credit, Guarantees, Collections, Drafts and International Checks. -

Treasury

Bantotal Treasury allows the Financial Institution to offer its customers a global vision of its portfolio through a scalable system in terms of product variety and business volume. -

Mutual Funds

Bantotal Mutual Funds is a solution that allows the Financial Institution to offer their customers access to a diverse portfolio, starting from a reduced volume of money, seeking to give liquidity, security and rentability to said savings. -

Compliance

It is the solution that ensures Financial Institutions are in compliance with the regulations of the country it operates in, as well as the Foreign Account Tax Compliance Act (FATCA) and the International Financial Reporting Standards (IFRS). -

Cash Management

Bantotal Cash Management allows financial institutions to offer their customers payment, collection and transfer services, outsourcing their treasury and saving time and money. -

Banking as a Service

Bantotal Banking as a Service (BaaS) is the service that allows banks to offer their infrastructure and services so that Fintechs can provide banking products without the need for a banking license. -

Embedded Finance

Bantotal Finanças Incorporadas is the solution that allows financial institutions to integrate banking products into people's daily lives through collaborative agreements with non-financial organizations. -

BPay

BPay is a payment solution certified in multiple markets, which allows instant interbank transfers through different channels, considering the current norms and standards. -

BPeople

BPeople focuses on developing digital banking solutions that have a memorable impact on the customer experiences of financial institutions, offering innovation, market knowledge and implementation methodologies. -

BData

BData specializes in the development of data science and analysis methods and techniques, so that financial institutions can have observability, make intelligent decisions and optimize their business performance. -

BSaaS

BSaaS develops a set of specialized services to solve the financial processes required by financial and non-financial institutions under the Software as a Service modality. -

BStore

BStore provides Financial Institutions with relevant innovation that integrates and complements the platform so they can improve and grow in today's business context.

Contact us